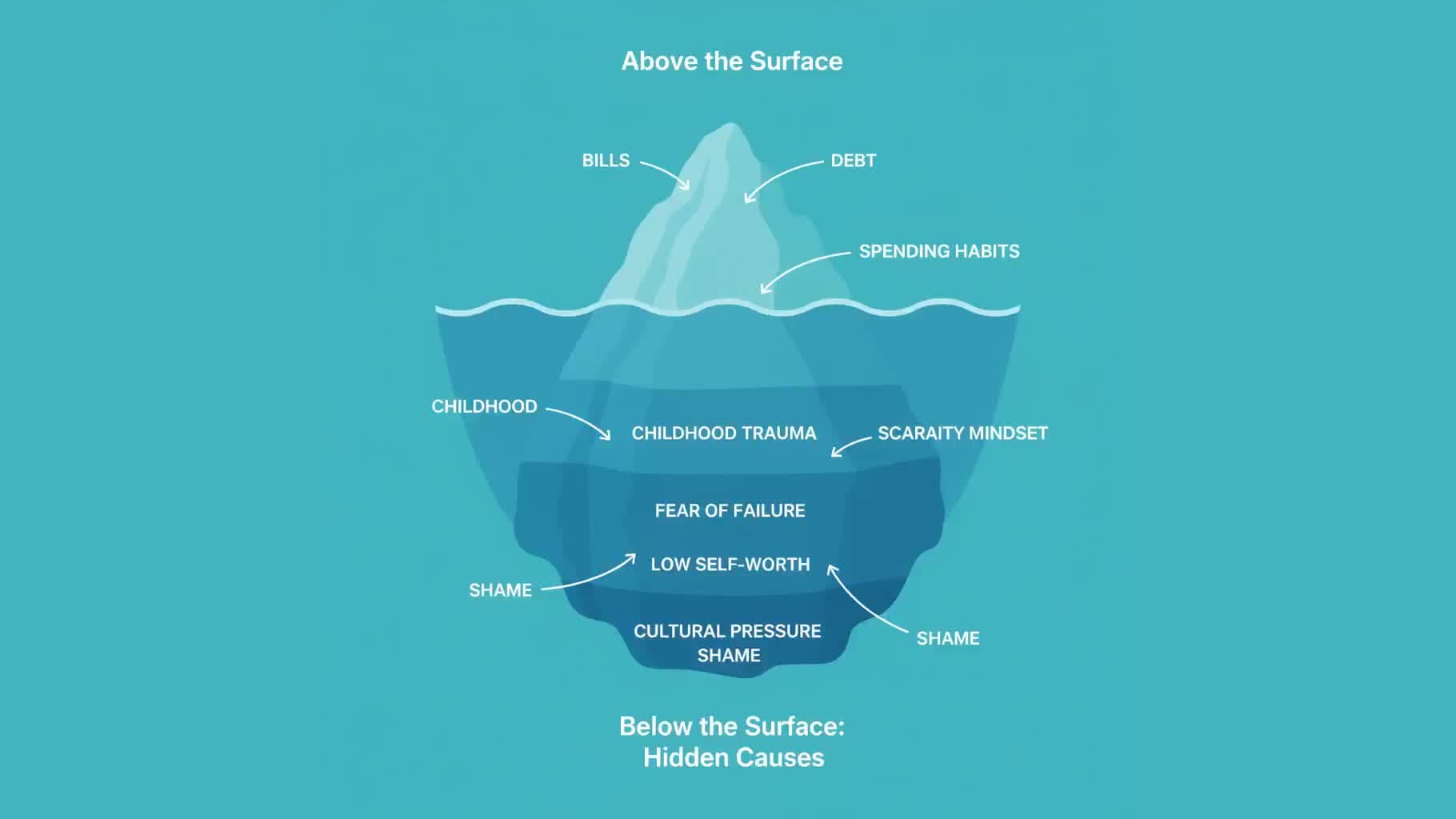

The Financial Anxiety Iceberg: What You See vs. What's Really Happening

Understanding financial stress isn't just about looking at bank balances; it's about recognizing the hidden psychological forces beneath the surface. Like an iceberg, where only 10% is visible above water while 90% lurks below, financial anxiety reveals itself through obvious symptoms while its deepest causes remain hidden from view. We at PsyFi think that finding the root psychological causes of money stress is the key to achieving financial wellness.

The Visible Symptoms: What Everyone Sees

When financial anxiety takes hold, certain behaviors become impossible to hide. You might find yourself checking your bank account obsessively sometimes multiple times per day yet paradoxically avoiding opening bills or financial statements[1][2]. Sleep disruption affects 77% of adults experiencing money worries, leaving them exhausted and unable to focus[3][4]. Arguments about money with partners intensify, social invitations get declined due to cost concerns, and physical symptoms like headaches, digestive issues, and muscle tension become daily companions[1][5][6].

These visible manifestations are just the tip of the iceberg. According to recent research, 72% of Americans report feeling stressed about money at least some time each month, with financial concerns now surpassing work, health, and relationships as the primary source of stress[7][8][9]. For Gen Z Canadians specifically, the pressure is even more acute: 64% experience financial stress multiple times per week, significantly higher than any other generation[10][11].

The pandemic and subsequent economic uncertainty have only amplified these concerns. In Canada, 55% of people feel anxious about their personal finances, and a staggering 42% could only cover basic expenses for less than one month if they lost their main income source[12][13]. These aren't just numbers they represent real people struggling with the weight of financial uncertainty every single day.

The Transition Zone: Insecurity, Guilt, and Decision Fatigue

Slightly below the waterline lies a layer of psychological experiences that people rarely discuss openly. This transitional zone includes the constant guilt after every purchase, no matter how necessary[5][14]. Decision fatigue sets in when every small choice from buying coffee to grocery shopping becomes a complex mental calculation that depletes cognitive resources[5][3].

Insecurity about one's financial situation prevents honest conversations with friends, family, or even financial professionals[15][16]. This shame can be so powerful that it creates avoidance behaviors: 32% of adults worry about paying bills, yet many avoid looking at their financial statements altogether[3][17]. The constant comparison to others, amplified by social media where 74% of people recognize their friends project false wealth online, fuels feelings of inadequacy and the pressure to spend beyond one's means[3][18].

Loss of self-worth becomes intertwined with financial status. When money equals identity, each financial setback feels like a personal failure rather than a circumstance to navigate[5][16]. The inability to plan for the future creates a shortened time horizon where survival mode takes over, making it impossible to think strategically about long-term financial goals[14][19].

Research shows this transitional zone is where the bidirectional relationship between financial and mental health becomes most evident. Financial challenges decrease mental well-being, while poor mental health simultaneously makes managing finances more difficult, creating a vicious cycle[1][2][20].

The Deep Waters: Hidden Psychological Causes

The deepest part of the financial anxiety iceberg contains the root causes that most people never examine. These hidden drivers shape our relationship with money in profound ways, yet remain largely invisible to conscious awareness.

Childhood Financial Hardships and Generational Patterns

Childhood experiences with poverty can be traumatic, creating protective behaviors around money that persist for decades[18][16][21]. If you've ever gone without food, housing, or basic necessities, your mind may latch onto worst-case scenarios more easily, even when your current situation is stable[18]. This trauma can span generations parents who lived through financial hardship often transmit heightened money anxiety to their children through attitudes, warnings, and expectations, even if those children never personally experienced deprivation[16][15].

Generational financial trauma refers to the emotional and psychological aftermath of financial stress experienced by earlier generations[16]. Research by Rachel Yehuda has demonstrated that the repercussions of stress and trauma can literally pass down through generations, affecting how descendants perceive and interact with money[16]. You don't need to have directly experienced your grandparents' Great Depression struggles to carry anxiety about financial security it can be transmitted through family narratives and behaviors.

Financial Abuse and Vicarious Trauma

Not all financial trauma comes from personal hardship. Vicarious or observational financial trauma develops from witnessing parents argue about money, watching family members lose homes to foreclosure, or observing how people are treated differently based on their economic status[16][21]. These observations shape beliefs about money and can create cycles of financial shame and avoidance that persist into adulthood.

Financial abuse is where one person controls another's access to economic resources leaving a lasting psychological scars that affect future money management and relationships[18][21][17]. Survivors may struggle with financial independence, experience anxiety around spending decisions, or sabotage their own financial success because of unprocessed trauma and understanding of stressors.

Cognitive Biases and Behavioral Economics

Even without trauma, our brains are wired with cognitive biases that work against sound financial decision-making. Loss aversion the tendency to fear losses more intensely than we value equivalent gains makes us hold onto losing investments too long or avoid necessary financial risks[22][23][24]. Present bias causes us to prioritize immediate rewards over future benefits, making it incredibly difficult to save for retirement when there's a tempting purchase available today[25][26].

The concept of cognitive bandwidth depletion explains why financial stress literally makes us less capable of good decisions[3][27]. When your mental resources are consumed by money worries, you have less capacity for planning, problem-solving, and emotional regulation. Studies show that the lack of money measurably affects cognitive performance, with research across 256 studies showing a negative effect of Hedge's g = -0.43[3]. This means financial stress doesn't just feel bad it actually impairs your ability to think your way out of the situation.

Identity and Self-Efficacy

For many people, money has become inseparably tangled with self-worth and identity[5][16][17]. When your sense of who you are depends on your bank balance or job title, every financial setback becomes an existential crisis rather than a problem to solve. Lack of financial self-efficacy the belief that you're competent to handle financial challenges leads to learned helplessness, where people feel trapped in their circumstances with no way forward[1][21].

Conversely, research shows that people with strong self-efficacy demonstrate lower levels of financial stress even when facing similar financial strains as those without it[1][28]. This suggests that building confidence in your financial decision-making capacity may be more important than simply increasing financial literacy.

Cultural Taboos and Workplace Trauma

Cultural money taboos make financial discussions feel shameful, preventing people from seeking help or learning from others' experiences[16][17]. In many cultures, talking openly about money is considered impolite or inappropriate, leaving people isolated in their struggles[29][18].

Workplace financial trauma stems from wage theft, discrimination, exploitation, and the pressure to "code-switch" in professional environments[16]. The normalization of hustle culture, where 39% of Gen Z work both a job and a side hustle, creates chronic stress and burnout that compounds financial anxiety[30][31].

The Science Behind the Iceberg: Research Insights

Understanding the financial anxiety iceberg isn't just theoretical it's backed by extensive research demonstrating the profound interconnection between money and mental health.

The Bidirectional Relationship

Multiple studies confirm a bidirectional relationship between financial health and mental health[1][2][20]. People with the lowest incomes in a community are 1.5 to 3 times more likely to experience common mental illnesses like depression and anxiety than the wealthiest in the same community[1][2]. Financial stress increases psychological distress, which in turn impairs financial decision-making, creating a downward spiral.

A 2022 study examining this relationship found that higher financial worries were significantly associated with higher psychological distress across all demographic groups, with the association being particularly strong among unmarried individuals, unemployed people, low-income households, and renters[2]. The researchers noted that even controlling for multiple variables, a 1-point increase in financial worries scale was associated with a 0.315 increase in psychological distress scale[2].

Physical Health Consequences

The mental burden of financial anxiety doesn't stay in your mind it manifests physically. People experiencing financial stress are twice as likely to report poor overall health and four times as likely to suffer from sleep problems, headaches, and other illnesses[9][4]. Long-term financial stress has been linked to serious conditions including heart disease, high blood pressure, and chronic pain[9][5][6].

Recent research on financial assets and mental health found that adults with less than $5,000 in accrued financial assets reported over two times the odds of screening positive for depression, anxiety, and co-occurring depression and anxiety compared to adults with $100,000 or more in financial assets[32]. This relationship persisted even after controlling for income, suggesting that the psychological security of having savings matters beyond just current earning capacity.

Generation-Specific Impacts

The financial anxiety iceberg looks different across generations. Gen Z faces unprecedented levels of financial stress, with less than one-third (31%) feeling financially secure and over half (52%) saying they are very or extremely worried about not having enough money[30][31]. This represents a significant increase from previous years, with the importance of making money rising from 32% in 2021 to 46% in 2023[30].

Nearly 70% of Gen Z rate their current financial situation as only "fair" or worse, with 32% rating their finances as poor or very poor[30]. For young Canadians specifically, 64% experience financial stress multiple times per week far more than Millennials (55%), Gen X (42%), or Boomers (27%)[10][11]. Perhaps most concerning, 47% of Gen Z report excessive anxiety or worry that is difficult to control on an ongoing basis[30].

The Role of Financial Knowledge vs. Financial Confidence

Interestingly, financial literacy alone doesn't solve the problem. While 72.5% of Canadians demonstrated positive financial knowledge, attitudes, and behaviors according to the Financial Consumer Agency of Canada's 2024-2025 National Financial Literacy Strategy, only 61% could correctly answer five of seven financial knowledge questions[13]. This gap suggests that confidence and perceived knowledge matter as much or more than actual knowledge.

Research confirms this: while the relationship between financial knowledge and financial stress appears mixed, confidence about one's financial knowledge (feeling financially educated and well-informed) has been strongly associated with lower anxiety[1][28]. This highlights the importance of not just teaching financial concepts, but building genuine financial self-efficacy.

Breaking the Cycle: Psychology-Driven Solutions

Traditional approaches to financial anxiety focus on budgeting tools, financial literacy programs, and debt management strategies. While these have their place, they fail to address the psychological iceberg beneath the surface. This is where psychology-driven financial wellness becomes transformational.

The Limitations of Traditional Approaches

Most financial education assumes people make rational decisions and simply need more information. But behavioral economics research over the past several decades has conclusively demonstrated that emotions drive financial decisions 80-90% of the time[26][23]. Giving someone a budget doesn't help if childhood trauma causes them to emotionally spend during stress. Teaching investment principles won't work if loss aversion makes them too fearful to start[22][33].

Moreover, people experiencing financial precarity often lack the cognitive and emotional bandwidth to act on information they receive[27][3]. When you're in survival mode, worried about making rent or feeding your family, your time horizon shrinks and your capacity for complex decision-making diminishes. Technology that provides information without addressing the emotional and psychological state of the user is fundamentally misdiagnosing the problem[27][34].

Behavioral Finance: A New Paradigm

Behavioral finance merges psychology and economics to understand how cognitive biases, emotions, and mental health influence financial choices[22][23][33]. This approach acknowledges that our relationships with money are connected to emotions, past experiences, cultural values, and personal identity not just mathematical optimization[26][29].

Key behavioral finance principles that address the hidden iceberg include:

Loss Aversion Framing: Rather than highlighting what you'll gain by saving, frame it as avoiding the loss of future security[24]. This leverages our natural tendency to fear losses more than we value gains.

Behavioral Nudges: Small, contextual prompts at decision points can dramatically shift behavior[33][35][36]. For example, automatically transferring money to savings immediately upon receiving your paycheck removes the temptation to spend it first[37].

Goal Visualization: Research shows people are significantly more likely to save when they can visualize their goals[37][24]. Attaching images to savings accounts and using progress tracking creates emotional connection and motivation.

Present Bias Mitigation: Using commitment devices, automated savings, and gamification with rewards helps overcome the natural tendency to prioritize immediate gratification over long-term goals[35][25].

Reducing Friction: Every additional step in a financial process increases the likelihood of abandonment[38][34]. Streamlining tasks and removing unnecessary complexity reduces cognitive load and decision fatigue.

Financial Therapy: Addressing Deep Trauma

For individuals whose financial anxiety stems from trauma, abuse, or deeply ingrained patterns, financial therapy provides more intensive support[28][26][29]. This specialized approach combines therapeutic techniques with financial guidance to help people:

· Understand how past experiences shape current money behaviors[15][16][21]

· Process financial trauma and reduce shame[26][21]

· Develop healthier emotional relationships with money[29][17]

· Break generational patterns of financial dysfunction[16][39]

· Build financial self-efficacy and agency[1][21]

Financial therapy differs from financial planning in that it focuses on the emotional and psychological barriers preventing sound financial decisions, rather than just the technical how-to of money management[23][28][29]. It's particularly valuable for addressing what behavioral finance researcher Dr. Brad Klontz calls money scripts unconscious beliefs about money formed in childhood that drive adult financial behaviors[15][39].

Technology Meets Psychology: The PsyFi Approach

The future of financial wellness lies in technology platforms that integrate behavioral science principles from the ground up[40][33][41]. Rather than building budgeting apps that assume rational behavior, psychology-driven fintech acknowledges human limitations and works with them, not against them.

Effective psychology-driven platforms incorporate:

Real-time Behavioral Insights: AI-powered analysis of spending patterns that identifies emotional triggers and provides context-aware interventions[40][33][42]. For example, detecting stress-based purchasing patterns and offering calming prompts before impulse buys.

Personalized Nudges: Tailored interventions based on individual behavioral profiles, timing them for maximum effectiveness[33][35][36]. Someone with present bias might receive different nudges than someone with analysis paralysis.

Gamification with Purpose: Achievement streaks, progress visualization, and milestone rewards that make financial wellness engaging while building positive habits[33][35][43]. This isn't entertainment it's behavioral reinforcement that links mindset management with measurable outcomes.

Emotion-Aware Design: User interfaces that reduce stress rather than amplify it, using color psychology, simplified information architecture, and supportive language[34][44][45]. The best financial apps feel like a supportive friend, not a judgmental parent.

Hyper-Personalization: AI-driven recommendations that consider unique circumstances, preferences, and goals rather than one-size-fits-all advice[33][41][46]. Personalization based on behavioral data can dramatically increase engagement and outcomes.

Financial Self-Efficacy Building: Progressive challenges and educational content that builds confidence in financial decision-making[36][24]. Focus shifts from "you're doing it wrong" to "you're developing this skill."

PsyFi's Solution: Addressing the Whole Iceberg

At PsyFi, we've built a financial wellness platform specifically designed to address both the visible symptoms and hidden causes of financial anxiety. Our approach integrates 85+ psychology techniques including loss aversion framing, gamification streaks, and smart trigger alerts to help users save more effectively[24].

Our three-step journey Save, Invest, and Build Wealth incorporates behavioral nudges at every decision point, helping users overcome cognitive biases that sabotage financial progress[24]. We use future-self visualization and wealth projections to make long-term goals feel real and attainable, counteracting present bias[24]. Daily check-ins and progress tracking provide the consistent reinforcement needed to build lasting financial habits[24].

Unlike traditional financial apps that focus solely on transactions and balances, PsyFi addresses the psychological iceberg beneath your financial behaviors. Our AI coaching understands that managing money isn't just about math it's about emotions, past experiences, and the complex relationship between your identity and your finances[24].

We've seen users improve consistency and reduce financial slip-ups by up to 40% by working with behavioral science rather than fighting against human nature[24]. Because when you address the hidden psychological causes of financial anxiety, the visible symptoms naturally begin to resolve.

Taking Action: Moving Forward

Understanding the financial anxiety iceberg is the first step toward lasting change. But awareness alone isn't enough you need tools and strategies that work with your psychology, not against it.

Immediate Steps You Can Take

Name Your Iceberg: Take time to reflect on what's really driving your financial anxiety. Is it childhood messages about money? Fear of repeating family patterns? Identity tied to financial status? Write down both visible symptoms and potential hidden causes[16][21].

Build Financial Self-Efficacy: Start with small, achievable financial goals that build confidence[1][28][24]. Success breeds confidence, which reduces anxiety and improves decision-making.

Automate Good Behavior: Use commitment devices and automation to remove willpower from the equation[37][35]. Set up automatic transfers to savings immediately upon receiving income, before you have a chance to spend it.

Visualize Your Goals: Attach images to your financial goals and track progress visually[37][24]. Make your future self feel real and worthy of present sacrifice.

Address the Emotional Component: Consider working with a financial therapist if trauma, shame, or deeply ingrained patterns are holding you back[28][29][21]. Sometimes professional support is necessary to process the hidden iceberg.

Use Psychology-Driven Tools: Choose financial apps and platforms that incorporate behavioral science principles rather than just tracking[40][33][24]. Look for features like personalized nudges, emotion-aware design, and gamification that builds genuine skills.

The Path Forward

Financial anxiety doesn't have to control your life. By understanding the full iceberg both what's visible and what's hidden you can begin addressing the root psychological causes rather than just managing surface symptoms. The research is clear: financial and mental well-being are deeply intertwined[1][2][20][4]. Holistic interventions that address both simultaneously are more effective than treating either in isolation.

The future of financial wellness lies in platforms that meet people where they are psychologically, acknowledge the emotional complexity of money, and provide tools that work with human nature rather than demanding superhuman rationality[40][27][41]. At PsyFi, we're committed to building that future one where your financial journey is uniquely yours, personalized to your mindset, your goals, and how you actually think about money[24].

Conclusion: Beneath the Surface

The financial anxiety you see the sleepless nights, the arguments, the obsessive account checking is real and valid. But it's only the tip of the iceberg. Beneath the surface lie deeper truths: childhood experiences that shaped your money mindset, generational patterns you're unconsciously repeating, cognitive biases sabotaging your best intentions, and a complex relationship between your identity and your finances.

Traditional financial advice tells you to budget better, save more, and invest wisely. But if you're carrying financial trauma, battling cognitive biases, and operating with depleted mental bandwidth, these instructions feel impossible to follow. The problem isn't lack of willpower or discipline it's that we've been addressing symptoms while ignoring causes.

The good news? Once you understand the whole iceberg, you can address it holistically. With psychology-driven tools, behavioral science techniques, and platforms designed around how humans actually work, lasting financial wellness becomes achievable. You don't have to fight your own psychology you can work with it.

Your financial journey is more than numbers on a screen. It's emotions, memories, fears, hopes, and the deep human need for security and self-worth. At PsyFi, we see the whole iceberg. And we're here to help you navigate it.

Ready to address your financial anxiety at its roots? Discover how PsyFi's psychology-driven approach can transform your relationship with money at psyfiapp.com[24].

Citation:

1. https://finhealthnetwork.org/research/understanding-the-mental-financial-health-connection/

2. https://pmc.ncbi.nlm.nih.gov/articles/PMC8806009/

3. https://www.moneyandmentalhealth.org/money-and-mental-health-facts/

4. https://harbormentalhealth.com/2025/07/01/impact-of-financial-anxiety-on-health-2025/

5. https://www.ig.ca/en/insights/eight-hidden-psychological-costs-of-financial-nbsp-stress

6. https://aneskey.com/money-stress-and-the-body-the-pain-we-dont-always-notice/

7. https://www.apa.org/news/podcasts/speaking-of-psychology/financial-stress

10. https://globalnews.ca/news/11480640/generation-z-mental-health-financial-struggles/

14. https://renucounselling.ca/financial-anxiety-mental-health/

15. https://homewoodhealthcentre.com/articles/the-psychology-of-debt/

18. https://www.healthline.com/health/anxiety/money-anxiety

19. https://www.voyagerway.com/why-do-we-worry-about-money-even-when-we-have-enough/

20. https://www.moneyandmentalhealth.org/money-and-mental-health-facts/

21. https://findingchangetherapy.ca/blog/financial-trauma-the-hidden-reason-behind-your-money-struggles

22. https://www.meegle.com/en_us/topics/behavioral-finance/behavioral-finance-and-mental-health

26. https://www.mindmoneybalance.com/blogandvideos/what-is-financial-therapy-become-financial-therapist

28. https://www.consolidatedcreditcanada.ca/financial-news/what-is-financial-therapy/

29. https://www.investopedia.com/terms/f/financial-therapy.asp

31. https://www.stress.org/news/gen-z-faces-financial-challenges-stress-anxiety-and-an-uncertain-future/

32. https://www.nature.com/articles/s41598-024-76990-x

33. https://blogs.emorphis.com/behavioral-finance-apps-fintech-innovation/

34. https://thisisglance.com/blog/fintech-apps-the-psychology-of-financial-user-behaviour

35. https://www.billcut.com/blogs/how-spending-tracker-apps-use-behavioral-finance-principles/

36. https://pmc.ncbi.nlm.nih.gov/articles/PMC8328350/

40. https://www.bobsguide.com/how-can-fintech-support-mental-health-and-financial-wellbeing/

43. https://emoneyadvisor.com/blog/why-financial-wellness-technology-needs-gamification/

44. https://dashdevs.com/blog/how-behavioral-finance-and-customer-experience-drive-fintech/

46. https://www.meegle.com/en_us/topics/behavioral-finance/behavioral-finance-applications

47. https://ia.ca/business/insights/group-insurance/financial-stress-and-mental-health

50. https://www.sciencedirect.com/science/article/abs/pii/S0001879122000720

51. https://www150.statcan.gc.ca/n1/daily-quotidien/240815/dq240815b-eng.htm

53. https://munchiesandmunchkins.com/how-invisible-conditions-affect-everyday-life-and-finances/

54. https://www.cnn.com/2021/08/09/health/financial-stress-covid-pandemic-effects-tips-wellness

55. https://www.psychologytoday.com/ca/blog/in-therapy/201605/letter-therapists-beware-financial-stress

56. https://qxplore.com/the-hidden-cost-of-financial-stress-and-what-you-can-do-about-it/

59. https://www.spergel.ca/learning-centre/everyday-spending/

60. https://www.sciencedirect.com/science/article/pii/S0277953624010153

61. https://mexicobusiness.news/health/news/fintechs-role-alleviating-stress-and-promoting-mental-health

62. https://pmc.ncbi.nlm.nih.gov/articles/PMC9680645/

65. https://pmc.ncbi.nlm.nih.gov/articles/PMC12079407/

66. https://blog.beworks.com/becurious/personal-finance-apps

67. https://www.sciencedirect.com/science/article/pii/S0001691825006213

69. https://www.elevenspace.co/blog/designing-for-financial-behavior-ux-that-builds-better-money-habits

70. https://www.seopital.co/blog/finance-keywords

72. https://www.reddit.com/r/fintech/comments/1oca052/comparing_a_few_finance_management_apps_which_one/

73. https://www.linkedin.com/pulse/seo-financial-services-softtrix-web-solutions-ytlic

74. https://matomo.org/blog/2024/07/fintech-content-marketing/

75. https://finance.yahoo.com/news/psifi-announces-major-private-alpha-164500363.html

76. https://socialspike.ca/top-keywords-for-financial-advisors/

77. https://www.curiouscatdigital.co.uk/insights/fintech-content-marketing-growth-strategy

78. https://www.youtube.com/watch?v=YW01VlxaUXA

79. https://www.keysearch.co/top-keywords/personal-finance-keywords

80. https://www.fintech.ca/2024/01/23/content-marketing-trends-for-fintech-companies/

81. https://fullyvested.com/insights/seo-for-finacial-services/

82. https://mintposition.co/fintech-content-marketing-examples/

83. https://www.omnius.so/blog/seo-for-financial-services-and-products

84. https://www.omnius.so/blog/how-to-create-fintech-content-strategy

85. https://thefinanser.com/2025/04/when-money-think-for-you

86. https://www.promodo.com/blog/6-top-seo-trends-in-finance

88. https://www.soarpay.com/2024/08/irrational-labs/

89. https://fpcanada.ca/2025-financial-stress-index

90. https://www.linkedin.com/pulse/journey-financial-services-design-started-from-losing-alex-kreger

91. https://www.bankofcanada.ca/2025/05/financial-stability-report-2025/

94. https://www.canada.ca/en/financial-consumer-agency/programs/research/summary-covid-19-surveys.html

95. https://finance.yahoo.com/news/gen-z-financial-anxiety-generation-140000537.html